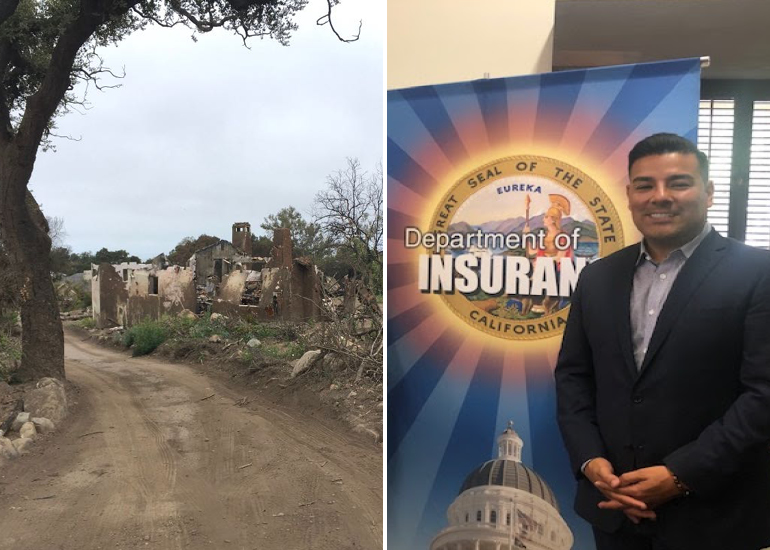

Sharon Byrne, executive director of the Montecito Association, sent out another excellent update on the dire insurance situation in Montecito and beyond: Policies aren’t being renewed, and new coverage is hard to come by (and/or shockingly expensive). The organization’s insurance committee met with a group from the office of California insurance commissioner Ricardo Lara (above) to discuss the following:

We collected data on this problem, mapped out the results, and learned some things:

1. Non-renewals occur more frequently above 192 and near any sloping hills. Our Fire Chief Kevin Taylor feels this may be due to that area being designated by Cal Fire as “Extremely High Risk of Wildfire.” Everything below 192 is designated “High Risk of Wildfire.” We wondered why we would be in this designation, given the Thomas Fire. When it hit the old Tea Fire burn scar, it stalled, indicating that an area that has burned will not do so for at least another decade. Why are we then still at “Extremely High Wildfire Risk”?

2. Placement in or out of the evacuation zones from the county’s OEM map doesn’t seem to have an effect on coverage. Many people were able to renew their insurance in these zones.

3. Internal memos from insurance companies indicate they’ve seen 17 years of gains in this market wiped out in 2018. They’ve decided collectively to aggressively shed risk by reducing their exposure in this market, and they accomplish that by declining to renew policies. They’re also raising premiums to recover losses.

4. Chubb is the main company not renewing our homeowners. They covered 60% of this market.

5. Some in our community are finding replacement coverage with these companies, but at higher prices:

—Lloyds – much higher premiums and deductibles, as much as 5-10x higher.

—Northlight through Allstate – somewhat higher premiums and deductibles

—PURE – higher deductibles

—Travellers – sometimes through Geico – 30% higher premium

—Pacific Specialty

—Lexington – much higher premiums and deductibles

—Pursuing assistance from the state of California:

Thus, it would seem that the insurers are less concerned about debris flow now than fire, which is more likely to happen again. Also, that list of insurers is handy for those of us who need to do a lot of calling around.

The Montecito Association convened a meeting of state and local officials, including California insurance commissioner Ricardo Lara and assemblymember Monique Limón. Of note from Lara:

• Insurers can only raise rates up to 6.9% annually without having to file with the state legislature. More than 100 rate increases were filed since 2017.

• California’s FAIR plan is a plan of last resort, but only offers up to $1.5 million in coverage – too low for today’s needs.

• Insurers presently only have to notify you 45 days in advance of non-renewal. That’s too little time to maneuver to find a new policy in an incredibly tight market.

Lara is working on a bill to address many of these issues:

SB 824 – proposed by Lara – requires insurers to match risk of wildfire to actual loss in an area. This creates a more credible rating for homeowners in a higher risk area. Requires insurers to write policies for homes that have been ‘hardened’ against fire risk and accept community efforts at wildfire mitigation in their rating process. This one is a big deal for Montecito, as we’ve engaged in multiple resilience efforts to reduce our risk. This law would also extend the window of non-renewal notification by an additional 180 days. He also wants to increase the limits of the California Fair Plan, which could help a lot of people. He believes insurance companies need to make simple 1-3 sheet summaries of your coverage for you so you know what you’re covered for at a glance.

And his office maintains online resources that folks in this area might find helpful: Filing a complaint regarding an insurer; assistance finding an insurer for those in a “disaster zone”; and a rundown of insurers in California. You can also call his office at 800-927-4357, and his full presentation is on the Montecito Association’s website.

There’s more in the association’s update about what it would like from Lara and Limón.

Photo of Lara courtesy the Montecito Association.

This is such valuable work being done by the Montecito Association!